CHAPTER 2 – INTRODUCTION TO BIBLICAL ECONOMICS

Money

In Genesis 2:12, before sin entered the world, God specifically pointed out a large cache of gold He deposited in the earth and said that it was “good”. Gold is often equated with money in scripture.

Money is a claim on future property. To say money is evil would be to say private ownership is evil. This is an anti-biblical position. Without money and private property, there would be no such things as stewardship, generosity, saving, inheritances, or just deserts for honest labor. The commandments not to steal or envy another’s wealth would be meaningless.

Money is also a store of value and a medium of exchange. It exponentially streamlines any economic system. Instead of a cumbersome bartering process, money can be easily exchanged for any good or service with the understanding the new possessor will be able to do the same thing in turn. Money serves this function as long as everyone trusts that everyone else will accept it as payment.

Many things have served as money through history – livestock, grain, rice, tobacco, different metals, and bills of credit from trustworthy governments or private enterprises. However, the foundational fallback has also been gold because it possesses the optimum combination of traits for good money: Intrinsic value (desirability), non-counterfeit-ability, divisibility/ malleability, durability, and portability.

Money has never needed to be created or controlled by any government to function well. It arises organically whenever a person or group has goods or services that another person or group wants. However, because of its power, most governments want to be in control of what can be used as money and, if possible, assume the power to create new money out of thin air.

Because money is so powerful, the Bible repeatedly warns against loving (idolizing) it or finding our security in it (ex. Ecclesiastes 5:10, Proverbs 11:28, 1 Timothy 3:3, 6:10, Hebrews 13:5). Scripture even appears to teach that the love of wealth was part of what caused Satan to fall. Ezekiel 28:14-16 says, “You were the anointed cherub who covers… you were blameless in your ways from the day you were created until unrighteousness was found in you. By the abundance of your trade you were internally filled with violence, and you sinned; therefore I have cast you as profane… and I have destroyed you, O covering cherub.” Since scripture teaches the spiritual realm, in some ways, reflects the physical realm, it would not be surprising if there is wealth, money, and private stewardship in heaven. Jesus even exhorted us to store up treasure there.

Being made in God’s image means we are creators. We love to imagine and create and labor and build and accomplish things. If you can labor to create something, then you can own it. If you can own something, then you can give it away or trade it for something else. If you can trade something, then you can use an intermediary for trading. That’s money.

Labor and Competition

The creation came into being because God worked. Adam was given labor to perform before there was sin in the world. As stated, labor, creativity, and accomplishment are parts of God’s nature and they are part of our natures as well. They are good, godly endeavors in their original state. In fact, the first time in scripture someone was filled with God’s Spirit, it was to perform labor creating beautiful artistic designs in metal, stone, and wood (Exodus 31:2-5).

Ecclesiastes 4:4 says, “I have seen that every labor and every skill which is done is the result of rivalry [or competition] between a man and his neighbor.” In the fallen world, man is motivated more by self-interest than altruism. Therefore, competition to perform superior labor has an incredibly redeeming effect. We provoke one another, we challenge one another, we inspire one another, we bring out the best in one another… we compete.

We compete to earn a better grade, build a better product, or perform a better service. And, if done honestly, we deserve the just fruits of our labor, including accolades and monetary gain. Whether we use those deserts to glorify God or glorify ourselves is eternally important, but nevertheless falls well outside of the jurisdiction of civil governments.

It does not matter if a brilliant inventor is motivated by greed or altruism. If he honestly creates a new product that raises quality of life, the result is the same either way. Everyone benefits. It does not matter if an ambitious businessman is motivated by greed or altruism. If he honestly offers a service at a low price that meets a legitimate demand, the result is the same either way. Everyone benefits. The same is true of every other type of labor. Like Solomon said in Ecclesiastes 4:4, every skill and labor is the result of competition, and skill and labor are very good things.

Freedom of Exchange

Does God care about economics? Does He care about honest money, fair prices, or freedom of exchange? Look at what scripture says:

“You shall have just balances, just weights, a just ephah, and a just hin; I am the Lord your God, who brought you out from the land of Egypt.” (Leviticus 19:36)

“You shall have a correct and honest weight; you shall have a correct and honest measure, so that your days may be prolonged in the land which the Lord your God is giving you.” (Deuteronomy 25:15)

“A false balance is an abomination to the Lord, but a just weight is His delight.” (Proverbs 11:1)

“A just balance and scales belong to the Lord; all the weights of the bag are His concern.” (Proverbs 16:11)

“Can I justify wicked scales and a bag of deceptive weights?” (Micah 6:11)

Scales and balances were used throughout the ancient world to prove that products and money were really worth what buyers and sellers claimed.

Scripture portrays righteous economic systems as having two characteristics: First, money is linked to an intrinsically valuable commodity such as gold, silver, or some other common medium of exchange. Second, prices are based on mutual agreement between buyers and sellers and are allowed to move up and down freely according to supply and demand.

The biblical role of civil government in the realm of economics is limited to criminalizing just three things:

1) Fraud – Lying about what is being purchased

2) Theft – Stealing money, goods, or services

3) Coercion – Forcing someone to purchase goods or services against his or her will

In a free market, price is a function of supply and demand – always. If the price goes up, either the supply has gone down, or the demand has gone up, or both – always. If the price goes down, the opposite is true. This applies to every type of good, service, labor, currency, or loan. Whatever price is agreed upon by both the buyer and seller is considered fair as long as there is no fraud, coercion, or theft by either party. This principle is called Freedom of Exchange. It is an essential ingredient for any free society.

When the conditions for a righteous economic system are met, the power of the free market to efficiently produced goods and services is one of the most incredible forces in the universe. This is no exaggeration.

A famous example of this power came in the seventies from a Christian and Nobel Prize-winning economist Milton Friedman, who focused on a simple, everyday product: a number two pencil. His example showed how raw materials and manufacturing processes from several different continents, requiring cooperation from tens of thousands of people from every conceivable background – people who did not know each other, and may have even hated each other – worked together with seamless harmony to precisely meet the world’s demand for number 2 pencils, month and after month, year after year. Whenever the demand shifted up or down, it was instantaneously communicated to all parties via free-floating price signals (for raw materials, labor, equipment, etc…) with a level of efficiency that no group of central planners could possibly approach, even with the most sophisticated computers in the world.

Now apply this same phenomenon to every imaginable product on every shelf in every store in the world and you can begin to appreciate the breathtaking complexity of the free market. This phenomenon also applies to every type of service and labor. It is no wonder the free market has been called “The Invisible Hand”.

Free-moving prices automatically tell a society with perfect precision how many pencils, books, apples, oranges, cars, phones, and televisions are needed and where they are needed. They tell the producers of these things whether they should expand operations, hire more people, buy more equipment, and lease more land/office space or whether they should do the opposite. And they tell those producers whether they are using their resources efficiently enough to compete with everyone else in their industry.

Free-moving prices also automatically tell a society how many doctors, lawyers, teachers, carpenters, janitors, accountants, and machinists are needed and where they are needed. And they tell those professionals whether their skills, knowledge, and work ethic are sufficient to compete with others in their fields.

Price Gouging or Just… Price?

It is interesting to note that the Bible depicts situations in which the prices of basic goods rose dramatically in response to natural market forces vis-à-vis supply and demand. For example, in Revelation 6, food is so scarce that a quart of wheat is sold for a day’s wages. Likewise, when Samaria was besieged in 2 Kings 6, a donkey’s head cost 80 pieces of silver. And in Genesis 47, a famine became so severe that there was no amount of money sellers would accept in exchange for food. In each of these passages, there is nothing to indicate that sellers acted greedily or immorally. Rather, the passages simply stated what the prices were, according to supply and demand.

A few years ago, I listened to a pastor opining in his sermon about store owners price gouging after a hurricane in the Caribbean. Due to limited supply, bags of ice were sold for ten dollars that normally would have been sold for two dollars. The pastor lambasted the greed of the vendors for taking advantage of people in a desperate situation.

His sentiment was understandable. However, if there were two or more businesses selling ice in proximity to one another (I was unable to find out whether this was the case after reading several articles) and they were all charging around $10, then greed had nothing to do with the price. They were selling ice for $10 because that is what it was worth.

In fact, it is theoretically possible those merchants could have been acting altruistically. Since everything (including food and water) is more valuable in the wake of a hurricane, their determination to charge what people were willing to pay might have been motivated by a desire to earn enough profit to purchase supplies for the desperate family members and friends.

Furthermore, if prices are allowed to rise and fall freely, in a period of heightened demand the market will find a way to meet that demand, which will in turn cause prices to normalize. Ironically, the pastor went on to point this out. Just before leaving the subject, he added:

“Of course, there are some people who say they should be allowed to price-gouge because the increased price will incentivize ice producers to flood the market, which will cause the price to drop, and in the end much more people will get more ice much more quickly.”

I immediately thought, “Wow, I couldn’t have said it better myself!” As long as and people are allowed to make mutually voluntary transactions, with no fraud, theft, or coercion, in the end everyone benefits.

Government Intervention

Whenever governments exceed their biblical role in economics, serious problems result. There are two primary ways governments intervene:

1) Price-fixing

2) Subsidizing

Price fixing creates either shortages or surpluses – always.

If the price is fixed low (called a “price ceiling”), there will be a shortage and rationing.

If the price is fixed high (called a “price floor”), there is be surplus.

This applies to every possible good, service, labor, currency, or loan.

Likewise, if the government fixes a high price for a particular type of good, service, or labor to “help” people in that industry earn more money, it will simply create waste and an unusable surplus. A good example of this is the minimum wage, which is a price floor for unskilled labor. In 2014 Washington State passed legislation to incrementally raise the minimum wage over the next four years from $9.47/hour to $15/hour. During that period, the University of Washington conducted “The Minimum Wage Study”, which showed that as the minimum wage rose, workers saw a reduction in hours that more than offset the wage increase, so the total amount of money paid out to the low-wage market declined. In other words, the price floor created a surplus of workers – or unemployment.

Sources:

Seattle Times, 6/26/2017, “UW Study Find Seattle’s Minimum Wage is Costing Jobs”

Washington Post, 6/26/2017, “A ‘Very Credible’ New Study on Seattle’s $15 Minimum Wage Has Bad News for Liberals”

There is one exception to the shortage/surplus rule: Borrowing fiat currency. The price of borrowing fiat currency (or interest rate) could theoretically never create a shortage because more currency can just be created out of thin air. So, instead of causing a shortage, this kind of price-fixing artificially heightens demand for borrowing and the things people typically borrow to purchase, like homes or higher education. The result is increased consumer debt and asset bubbles. This will be discussed more in the next chapter.

The other way governments typically exceed their biblical role is by helping people pay for, or subsidizing, certain goods or services. Subsidization increases demand and therefore price – always. It induces people to purchase more liberally than they would if they were paying for it all directly. If the government subsidizes medical care, education, food, housing, etc., the price of those things goes up.

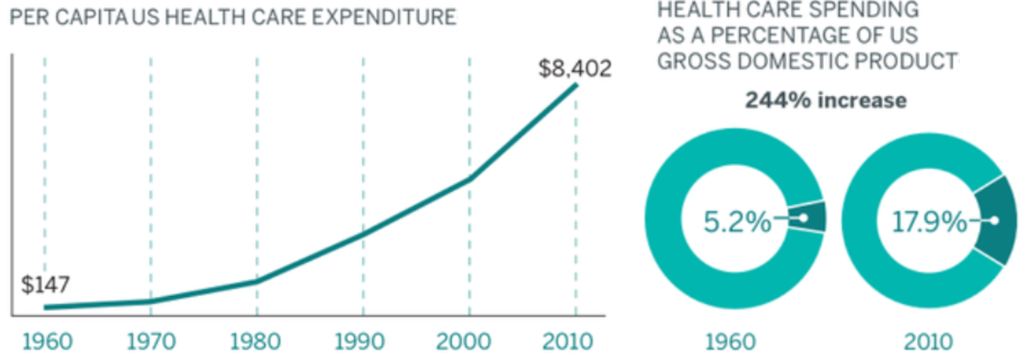

Healthcare in America is a good example of this. Business Insider reported that the per capita cost of health care rose steadily for decades well beyond the rate of inflation (from $147 in 1960 to $8,402 in 2010) as the government gradually expanded its role in that industry beginning with the introduction of Medicaid and Medicare. Likewise, healthcare spending as a percentage of Gross Domestic Product increased from 5.2% in 1960 to 17.9% in 2010.

Source:

Business Insider, 4/14/2014, “Three Charts Show How Healthcare Costs Have Exploded since 1960”